Insurance services are provided through First Republic Securities Company, DBA Grand Eagle Insurance Services, LLC, CA Insurance License # 0I13184, and First Republic Investment Management, Inc., DBA Eagle Private Insurance Services, CA Insurance License # 0K93728. Brokerage services are offered through First Republic Securities Company, LLC, Member FINRA/ SIPC. Trust and Fiduciary services are offered through First Republic Trust Company, a division of First Republic Bank and First Republic Trust Company of Delaware LLC and First Republic Trust Company of Wyoming LLC, both wholly owned subsidiaries of First Republic Bank. Investment Advisory services are provided by First Republic Investment Management, Inc. Once you understand the types of accounts most banks offer, you can begin to determine which option might be right for you.Privacy | Security & Fraud Prevention | Accessibility | Terms & Conditionsį provides information to clients about their accounts and financial services by First Republic Bank and its affiliates.īanking products and services are offered by First Republic Bank, Member FDIC and Equal Housing Lender You may want to discuss which type is best for you with your tax advisor before choosing your account. Both types of IRAs offer investment flexibility, tax advantages, and the same contribution limits. You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account, presumably in retirement. Traditional IRAs offers tax-deferred growth potential. Investment earnings are distributed tax-free in retirement, if the account was funded for more than five years and you are at least age 59½, or as a result of your death, disability, or using the first-time homebuyer exception. The Roth IRA offers tax-free growth potential. These accounts come in two types: the Traditional IRA and Roth IRA. These plans are useful if your employer doesn’t offer a 401(k) or other qualified employer sponsored retirement plan (QRP), including 403(b) and governmental 457(b), or you want to save more than your employer-sponsored plan allows. Individual Retirement Accounts (IRAs): IRAs, or Individual Retirement Accounts, allow you to save independently for your retirement.Some money market accounts also allow you to write checks against your funds, but may be on a more limited basis. Money market accounts can have tiered interest rates, providing more favorable rates based on higher balances.

Both savings and money market accounts have variable rates.

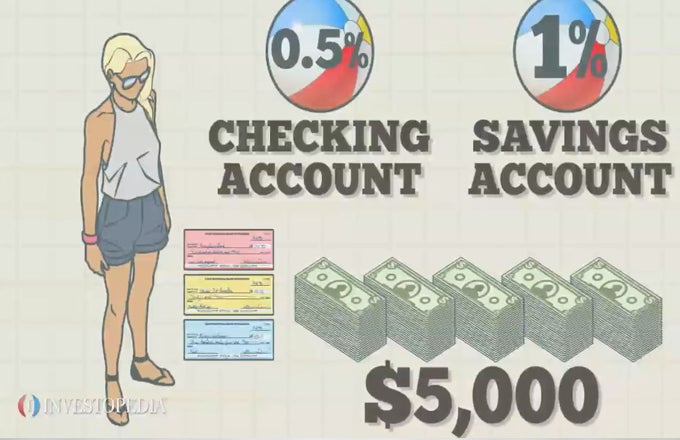

When you go to a bank to open a new account, you will have a variety of account types and features to choose from.

0 kommentar(er)

0 kommentar(er)